-

![img]()

SKYWORTH Cares: Standing Together in Difficult Times

Eisya Ereena

April 04, 2025

4 min

The recent pipeline fire incident in Putra Heights has deeply impacted many families, leaving them with the heartbreaking loss of their homes.In these challenging times, SKYWORTH stands in solidarity with the victims.As part of SKYWORTH's support, they will be providing household appliances to help affected families rebuild their homes and regain a sense of comfort.SKYWORTH believes that even in the darkest moments, kindness and unity can bring hope.How to Redeem Your SKYWORTH Product: Eligibility and Registration Details (Terms and Conditions)

Eligibility and Entry Restrictions

- This program is open only to victims affected by the Putra Heights Gas Pipeline Fire. Any ineligible entry submitted will be summarily disqualified and shall be non-appealable.

- Victims affected by the Putra Heights Gas Pipeline Fire can redeem only one (1) selected SKYWORTH product per household.

- Customers must provide personal details such as phone number, IC number, email address, and a Tenaga Nasional Berhad (TNB) bill statement to verify their affected household address. Missing information will result in disqualification.

- Registration for redemption will not be returned. It is recommended to keep a copy of your redemption details.

- Only victims affected by the Putra Heights Gas Pipeline Fire who register within the program duration (3rd April – 30th June 2025) are eligible to participate for the redemption. Participants must register via Google Form at https://forms.gle/aHP5pEfkK67BwUJL8. SKYWORTH will contact participants via WhatsApp to arrange delivery.

Start and Closing Date

- This program shall open for entries at the time and date specified on our website and/or social media channels and shall close as stated on those platforms. Unless otherwise stated, these times and dates follow UTC (Coordinated Universal Time).

- Any entries received after the program's closing date will be invalid and will not be accepted for any reason.

- SKYWORTH Malaysia is not responsible for any entries not received.

- SKYWORTH Malaysia reserves the right to cancel or amend the program and these terms and conditions without notice in the event of a catastrophe, war, civil or military disturbance, act of God, or any actual or anticipated breach of applicable law or regulation, or any other event beyond our control. Any changes will be notified to affected victims as soon as possible.

- Entry into this program will be deemed as acceptance of all terms and conditions.

Products Applicable

Each affected household can redeem only one (1) product from the list below.

Product delivery will be available from 3rd April to 31st October 2025.

Following is the list of products applicable.- Television: Model 50SUE7600

- Fridge: Model SRD-265WT

- Washing Machine: Model T90M26NJ

- Air Conditioner: Model SMFC12V

All products are non- transferable, non- exchangeable & non-refundable.

SKYWORTH Malaysia reserves the right to substitute any product with another of equivalent value without prior notice.

Limited to total 50 units for all categories on 1st come 1st serve basis.Copyright and Moral Rights

- SKYWORTH Malaysia shall disqualify any entry application/participation, whereby in its opinion and discretion, a participant has deliberately or negligently submitted a media content deemed obscene, defamatory, indecent, politically provocative or generally offensive in nature. Any entry application/participation submitted containing fraudulent information using a false identity or other particulars with the intention to deceive or misrepresent SKYWORTH Malaysia shall be disqualified accordingly.

- Participants agree to allow SKYWORTH Malaysia to use the information obtained throughout the application and registration process of the said program. SKYWORTH Malaysia may, for this purpose disclose any such information to third parties as may be required in accordance with proper business practice. SKYWORTH Malaysia is committed to the protection of participants’ rights to privacy and data security pursuant to the Personal Data Protection Act 2010 and relevant regulation thereof. SKYWORTH Malaysia ensures all personal information shall be processed diligently in compliance with existing law.

- For any reason, where any part of the program is not capable of being executed as planned by reason of, but not limited to, the infection by computer virus, bugs, tampering, unauthorized interception, fraud, negligence, technical failures or any other causes beyond the control of SKYWORTH Malaysia whereby having corrupted or affected the administration, security, fairness, integrity, or proper conduct of the said campaign, SKYWORTH Malaysia reserves the right to exercise its absolute discretion to disqualify any entry and/or cancel, terminate, modify or suspend the entry. SKYWORTH Malaysia in doing so shall not be liable or responsible thereof

Publicity

- We may undertake publicity activities relating to program and product. Participants, therefore, agrees to the use of their name, photograph and disclosure of town or region of residence in any post-product-redemption publicity names, surnames, towns or regions of residence and redemption details.

- All personal details collected as part of this program will be used in accordance with our Privacy Policy.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as medical advice from Motherhood. For any health-related concerns, it is advisable to consult with a qualified healthcare professional or medical practitioner.

For more insightful stories and fun recipes, stay tuned to Motherhood Story!

-

![img]()

A Celebration of Love and Luxury at Marriott Bonvoy Wedding Showcase 2025, powered by AFFIN Group

Eisya Ereena

April 04, 2025

4 min

Love is in the air, and Marriott Bonvoy is set to transform wedding dreams into reality with the highly anticipated Marriott Bonvoy Wedding Showcase 2025.

Set to take place on 26 and 27 April 2025 at The Starhill Atrium, this two-day event brings together 21 Marriott Bonvoy hotels and resorts across Malaysia, offering a stunning array of wedding venues, curated experiences, and bespoke services that promise to transform every love story into a once-in-a-lifetime celebration.

With the theme ‘Coastal Luxe: Waves of Romance’, this year's showcase embraces ocean-inspired beauty, blending serenity with sophistication.

For couples envisioning a grand ballroom affair, a tranquil garden ceremony, a sun-kissed beach wedding, an intimate glasshouse reception, or even an exclusive private island experience, bride and groom-to-be will discover endless possibilities to bring their fairytale nuptials to life.

Sponsored by AFFIN Group, guests will explore a bevy of wedding venues, interact with top-tier wedding vendors, and enjoy captivating experiences designed to inspire for two immersive days. Highlights include:- Bridal Fashion Shows by The Proposal and Gelly Wee Bridal House: Showcasing the latest in wedding couture, featuring exquisite designs from Oscar de la Renta, Reem Acra, Monique Lhuillier, Vivienne Westwood, Galia Lahav, Alex Perry and Ellie Saab. Expect a stunning display of elegance, romance, and modern sophistication, bringing the finest bridal trends to life.

- Live Performances: Surrender to the enchanting serenade of a string quartet, the soulful notes of a violinist, the evocative tones of an Er Hu, and the ethereal harmonies of a harp ensemble

- Augmented Reality and Virtual Try-Ons: Experience the future of bridal fashion with cutting-edge experiences such as augmented reality try-ons, allowing brides to envision themselves in their dream dress with just a touch of technology. Additionally, they can explore a 360° virtual view of respective wedding venues, bringing their wedding vision to life like never before.

- Jewelry Showcase: Discover dazzling collections, perfect for the big day.

- Elevated Wedding Beverages: hétam+ offers interactive specialty coffee wedding pop-ups, BoomGrow elevates mocktails with sustainably grown greens, and WonderBrew Kombucha Malaysia provides organic kombucha for a healthy wedding beverage experience.

'The Marriott Bonvoy Wedding Showcase 2025 is more than just an event - it's a celebration of love and the promise of beautiful beginnings.

We are incredibly excited to witness the dreams of couples materialise.

We have meticulously curated an unparalleled experience, one that we are confident will exceed all expectations.

Couples stand a chance to win exclusive prizes, including a partially sponsored wedding by Marriott Bonvoy, luxurious honeymoon stay at our finest resort, and the opportunity to earn 250,000 Marriott Bonvoy points.

This showcase reaffirms our unwavering commitment to providing truly exceptional wedding experiences, and we are eager to share this with all of Malaysia,' said Ramesh Jackson, Regional Vice President, Indonesia and Malaysia, Marriott International.Exclusive Offers and Grand Prizes

Marriott Bonvoy is elevating the wedding planning journey with exciting rewards for couples who confirm their wedding during the showcase, including:- Wedding on Us: Marriott Bonvoy will cover up to MYR150,000 towards a couple’s wedding package at its portfolio of hotels and resorts across Malaysia.

- Honeymoon on Us: A luxurious 4D3N honeymoon at The Ritz-Carlton, Langkawi, complete with business-class flights from Kuala Lumpur to Langkawi for two.

- Points On Us: 250,000 Marriott Bonvoy Points, redeemable for unforgettable stays, global experiences, and even significantly, towards your dream wedding

Couples who confirm and pay for their wedding at the event will stand a chance to win these luxurious gifts in a special contest.

To qualify, couples must:- Enroll as a Marriott Bonvoy member

- Share their love story by writing a short piece on why they wish to host their wedding with Marriott Bonvoy. Submit the story via the QR Code at the Marriott Bonvoy booth during the event

- Capture a special moment at the wedding fair

- Post it on Instagram with the event’s official hashtag #WeddingsMalaysia

A World of Wedding Possibilities

From the exquisite opulence of The St. Regis Kuala Lumpur to the island paradise of Perhentian Marriott Resort and Spa, the showcase features an unrivaled selection of Marriott Bonvoy hotels and resorts, each offering bespoke wedding packages tailored to every couple’s vision.

Participating properties include:- Luxury & Iconic Venues: The St. Regis Kuala Lumpur, W Kuala Lumpur, The St. Regis Langkawi, JW Marriott Kuala Lumpur, The Majestic KL

- Breathtaking Beach and Island Destinations: The Westin Langkawi Resort and Spa, Perhentian Marriott Resort & Spa

- Elegant City and Garden Weddings: Le Méridien Kuala Lumpur, Putrajaya Marriott Hotel, Palm Garden Hotel – A Tribute Portfolio Hotel

- Grand and Unique Ballrooms: Sheraton Imperial Kuala Lumpur, The Westin Kuala Lumpur, Le Méridien Putrajaya, Sheraton Petaling Jaya, Renaissance Kuala Lumpur Hotel & Convention Centre, Aloft Kuala Lumpur Sentral, Element Kuala Lumpur, Courtyard by Marriott Kuala Lumpur South, Courtyard by Marriott Setia Alam, Courtyard by Marriott Penang, Courtyard Marriott Melaka.

Your Journey to ‘I Do’ Begins Here

Min Luna Creative Agency, the savant organiser and the imaginative force behind this year’s showcase design together with expert wedding planners, vendors, exceptional venues, and unmatched hospitality, this event is designed to bring dream weddings to life as couples begin their journey together as one.

Datuk Wan Razly Abdullah, President and Group Chief Executive Officer of AFFIN Group, said, 'As we commemorate AFFIN’s 50th anniversary, this collaboration with Marriott Bonvoy for the prestigious wedding showcase marks a significant milestone in our AX28 transformation journey.

It reflects our commitment to delivering Unrivalled Customer Service, through strategic partnerships that align with the evolving life stages of our affluent clientele.

At AFFIN, we take pride in offering more than financial solutions, curating lasting memories steeped in elegance, service excellence, and the enduring values that have defined us for five decades.'

Save the date and embark on your journey to forever with Marriott Bonvoy this 26 & 27 April 2025.

For more information on participating hotels and vendors, check out Weddings by Marriott Bonvoy: Malaysia Showcase 2025.

Guests are invited to experience an unforgettable getaway with Marriott Bonvoy.

Members are eligible for complimentary Late Checkout, Welcome Gift, Enhanced Room Upgrade, and more. Earn and redeem points for free nights at any participating Marriott Bonvoy portfolio of hotels and resorts, at over 30 hotel brands in 10,000 global destinations.

To enrol for free, visit Join Marriott Bonvoy

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as medical advice from Motherhood. For any health-related concerns, it is advisable to consult with a qualified healthcare professional or medical practitioner.

For more insightful stories and fun recipes, stay tuned to Motherhood Story!

-

![img]()

IHH Healthcare Malaysia Strengthens Emergency Care Through Nationwide GP - Accident and Emergency Collaboration

Eisya Ereena

April 04, 2025

2 min

IHH Healthcare Malaysia, a leading private healthcare provider with a network of 18 hospitals nationwide, has successfully rolled out a series of Accident and Emergency (A&E) Collaboration events with General Practitioners (GPs) across the Central, Northern, and Southern regions, reinforcing the role of GPs as frontline partners in emergency care.

This initiative highlights IHH Healthcare Malaysia’s commitment to deliver timely, high-quality care by fostering stronger, seamless coordination between primary care providers and hospital emergency teams across its network, which includes Gleneagles Hospitals, Island Hospital, Pantai Hospitals, Prince Court Medical Centre and Timberland Medical Centre.

To operationalise this collaboration, IHH Healthcare Malaysia has implemented several key measures to enhance patient safety, streamline A&E referrals and optimise continuity of care:- Timely Patient Updates for GPs: GPs will receive timely clinical updates on patients referred to A&E departments across IHH Healthcare Malaysia’s hospitals, ensuring continuity of care and informed follow-up management.

- Direct Access to A&E Teams: Dedicated phone lines will allow GPs to connect directly with A&E teams for urgent referrals, enabling prompt decision-making and early intervention.

- Seamless Two-Way Communication: Structured communication channels between GPs and A&E departments will ensure smoother patient clinical handovers, real-time updates and coordinated care delivery.

- GP Masterclasses & Practical Sessions: Expert-led sessions will equip GPs with up- to-date clinical skills in emergency care, including ENT emergencies, fracture recognition, suturing techniques and ECG interpretation.

- Basic Life Support (BLS) Training: To boost pre-hospital emergency readiness, GPs and their teams will receive training in CPR, AED and essential emergency response.

The inaugural events saw participation from GPs representing over 130 clinics across Malaysia, demonstrating strong interest and commitment from the primary care community in enhancing emergency response capabilities.

Jean-François Naa, CEO of IHH Healthcare Malaysia, said, 'Primary care is the foundation of a resilient healthcare system, and GPs are often the first point of contact for patients.

Through this collaboration, we are strengthening that vital role – ensuring GPs have direct access, streamlined referral pathways and timely clinical support when patients need hospital care.

Our goal is to deliver comprehensive care at every stage of the patient journey, with seamless continuity from clinic to hospital and back.'

Dr Jeewadas Baladas, Consultant Emergency Physician and Head of Emergency Services at IHH Healthcare Malaysia, said, 'From pre-hospital care to A&E admission and beyond, every step in the patient journey is vital.

Closer collaboration between GPs and our A&E teams ensures timely, evidence-based care for patients when clinically indicated.

Our 18 A&E departments follow a standardised triaging system and clinical pathways, ensuring consistent, high-quality emergency care.'

The nationwide rollout of this collaboration marks a step forward in redefining emergency care delivery in Malaysia.

By bridging the gap between GPs and emergency departments through timely access, structured communication and shared clinical responsibility, IHH Healthcare Malaysia is setting new standards for responsiveness, coordination, and excellence in patient care.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as medical advice from Motherhood. For any health-related concerns, it is advisable to consult with a qualified healthcare professional or medical practitioner.

For more insightful stories and fun recipes, stay tuned to Motherhood Story!

-

![img]()

Malaysia’s Legacy Crisis: 85% Are Unprepared to Secure Their Family’s Future: Sun Life Malaysia Insurance Literacy Survey 2024/25

Eisya Ereena

March 28, 2025

4 min

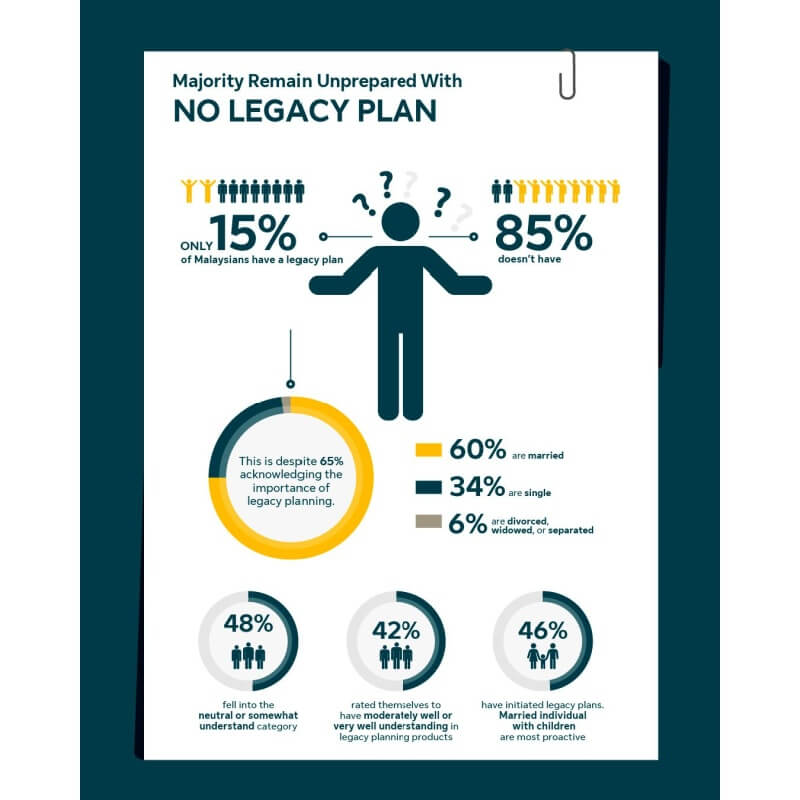

85% of Malaysians face a looming legacy crisis without a financial legacy plan in place.

This conclusion is highlighted in a Sun Life Malaysia’s survey 'Insure or Unsure: Sun Life Insurance Literacy Survey 2025' examining Malaysians' level of knowledge and behaviour towards insurance literacy and legacy planning.

The survey reported that only a small percentage of Malaysians have taken concrete steps towards family wealth planning, despite the majority possessing a self-perceived understanding of the subject.

The survey was conducted among 1,040 Malaysians across different income brackets and geographical locations.A Society at Risk

Raymond Lew, President/Country Head of Sun Life Malaysia

Raymond Lew, President/Country Head of Sun Life Malaysia

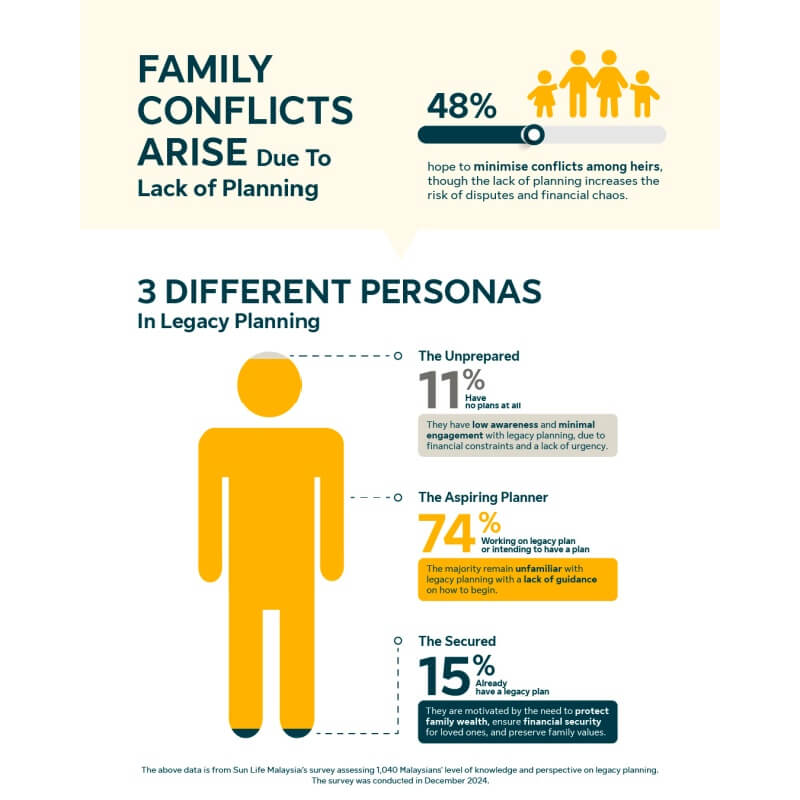

The survey revealed a troubling disconnect: while 65% of Malaysians acknowledge the importance of legacy planning, only 15% have taken concrete steps to safeguard their family’s financial future.

Proactive planners tend to utilise tools such as insurance/Takaful (71%), trust funds (53%), and wills (44%), yet the majority remain unprepared, leaving their families vulnerable to financial instability, potential conflicts, and the absence of intergenerational wealth transfer.

'We are building upon our previous year’s survey which focused on how insurance and takaful literacy impacts financial wellness.

In this second edition, we aim to delve deeper by exploring how financial legacy planning impacts financial security,' said Raymond Lew, President/Country Head of Sun Life Malaysia.

'Unfortunately, the results shine a spotlight on a worrying phenomenon.

The majority of families are unprepared, placing their loved ones at significant risk of financial insecurity.

With a more unified approach that respects cultural nuances and provides accessible tools, we can reverse this trend and secure brighter futures for Malaysian families.'

Among the 65% who recognise the need for legacy planning, 60% are married, 34% are single, and 6% are divorced, widowed, or separated, suggesting that married individuals with children are most aware of the need to secure wealth within their families.

Without a solid plan, however, they still risk the financial security of their dependents.

The findings also highlight that cultural and religious beliefs significantly shape legacy planning practices, particularly among Malay respondents who favor Islamic inheritance tools such as Hibah (a gift) and Wasiat (Islamic wills), in adherence to Shariah law.

These practices underscore the importance of culturally tailored guidance to meet the diverse needs of Malaysian families.

Encouragingly, 54% of those who have initiated legacy planning sought professional advice, indicating a growing trust in experts to navigate the complexities of legacy planning.

However, for families without clear plans, the lack of professional guidance or culturally appropriate tools increases the likelihood of disputes, especially in Malaysia’s diverse and increasingly blended family structures.Barriers Preventing Progress

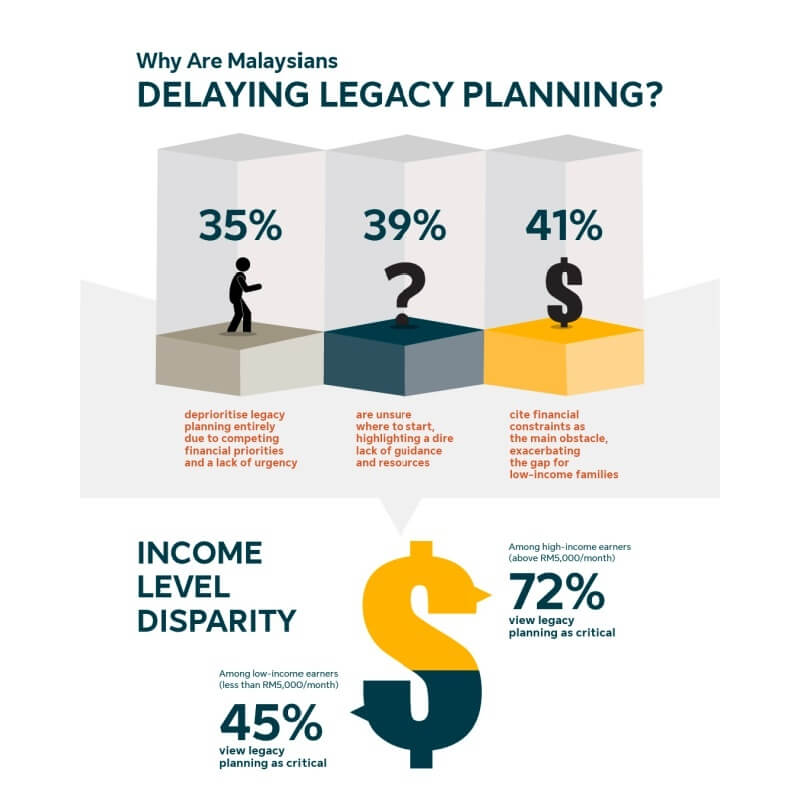

The survey revealed systemic obstacles that hinder Malaysians from prioritising legacy planning.- Financial Constraints (41%): Low-income families face the greatest hurdles, with 68% of non-planners earning below RM5,249/month.

- Lack of Knowledge (39%): Many Malaysians remain unsure of how to begin, highlighting a lack of accessible resources and guidance.

- Competing Financial Goals (35%): Immediate needs often overshadow long-term planning, especially among single individuals and childless couples.

The Silent Wealth Divide

The findings expose a growing wealth gap in legacy planning.

Among high-income earners with more than RM5,000 monthly household income, 72% view legacy planning as critical.

Conversely, only 45% of low-income earners with less than RM2,000 monthly household income view legacy planning as important.

Additionally, among 11% of survey respondents who have not taken any steps towards legacy planning, 68% belong to the lower-income group and are completely disengaged from the topic, creating a ticking time bomb for wealth inequality.Family Feuds on the Horizon

The lack of legacy planning exacerbates the risk of disputes among heirs, with 48% of Malaysians citing minimising conflicts as a top priority.

Blended and mixed-culture families, however, lead by example, with 82% actively discussing their plans compared to less proactive nuclear households.

'Without a solid plan, families are left vulnerable to financial turmoil and relational rifts–an issue that is particularly pronounced in Malaysia’s multicultural landscape and with the growing prevalence of blended families,' added Raymond Lew.

'We often witness how the absence of proper financial planning leads to not only financial hardship but also strained relationships among family members left behind.

This underscores the critical need to prioritise family wealth management early to safeguard both financial security and familial harmony.'Improved Literacy but Not Enough

Self-perceived insurance/takaful literacy or understanding levels improved from 28% in 2023 to 35% in 2024, attributed to initiatives like Sun Life Malaysia’s year-long InsureLit campaign.

However, 23% of respondents still lack basic understanding, underscoring the need for continuous education.

'We are glad to see a rise in the number of Malaysians with positive insurance literacy levels, contributed in part by our InsureLit campaign since last year.

Nevertheless, there remains a continued need for awareness initiatives among Malaysians as we hope to ensure that every Malaysian is well-protected financially, and insurance/takaful knowledge plays a big part in helping them achieve it,' added Raymond Lew.United Approach to Save a Society on the Brink of a Legacy Crisis

(Left to Right) Mr Raymond Lew, President and Country Head of Sun Life Malaysia, Mr Alvis Wee, Chief Distribution & Marketing Officer, Sun Life Malaysia, Mr Yuen Tuck Siew, CEO, Jirnexu and Dr Malar Santhi Santheras

(Left to Right) Mr Raymond Lew, President and Country Head of Sun Life Malaysia, Mr Alvis Wee, Chief Distribution & Marketing Officer, Sun Life Malaysia, Mr Yuen Tuck Siew, CEO, Jirnexu and Dr Malar Santhi Santheras

Now in its second year, the Insurelit campaign by Sun Life Malaysia aims to raise insurance literacy levels of Malaysians, particularly legacy planning, to ensure that families are prepared to face.

'Malaysia’s families are the bedrock of our society. We must empower them with the knowledge, tools and solutions needed to ensure stability and prosperity for future generations,' expressed Raymond Lew.

'There needs to be a concerted effort by financial institutions, policymakers, community leaders and individuals to address this crisis, be it making legacy planning accessible for all income levels or offering multilingual resources to guide Malaysians in this area,' expressed Raymond Lew.

Building on the success of InsureLit Campaign 2024, Sun Life Malaysia plans to amplify its efforts in 2025 with targeted initiatives, including digital and social educational resources, roadshows, explainer video series, youth financial literacy programme and more.

In 2024, the Insurelit campaign included educational programs to promote financial literacy among children, brand activations such as a wellness festival to instill health and wellness habits, innovative product launches, and nationwide roadshows, all designed to enhance financial and insurance literacy while empowering Malaysians to take control of their financial wellbeing.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as medical advice from Motherhood. For any health-related concerns, it is advisable to consult with a qualified healthcare professional or medical practitioner.

For more insightful stories and fun recipes, stay tuned to Motherhood Story!

-

![img]()

Here's How You Can Protect Your Family's Future

Zakwan Shah

March 28, 2025

10 min

In a world full of uncertainties, us parents worry everyday about the fate of our loved ones.

Whether that’s our children, our spouse or our family members, the future can be a scary place that we cannot predict.

But that doesn’t mean we are helpless to protect those who are near and dear to our hearts.

Should we no longer be around to take care of them, there are ways to ensure that they are well looked after.

AIA offers this protection for your next of kin in the event of your passing.Safeguard Your Little One’s Future

Our children are our prized possessions, one of the only lasting legacy we leave behind when our time comes. It is every parent’s deepest desire to give their little ones a fighting chance.

If we can, we’d put up protections straight from the cradle. But you don’t have to stop there!

There’s a way to ensure your child’s financial safety even before they enter the world.A-Life Joy Xtra

Looking for a guardian angel to watch over your little one throughout their lives? A-Life Joy Xtra offers financial protection to your child from the womb.

This flexible investment-linked plan provides insurance coverage and savings opportunities for your child. Protection starts as early as pregnancy (13 to 35 weeks) and between 14 days to 15 years old.

Here are other the benefits of this package:- Coverage period up to 70, 80 or 100 years old

- Coverage will automatically be doubled when your child turns 18

- Build an education savings fund for your child (qualified for tax relief)

- Your child gets lump sum payment should you suffer death or permanent disability before they turn 25.

*Terms and conditions applyMalaysian Mums Love AIA

Get Your Affairs in Order

None of us want to think the unthinkable, and yet the unthinkable happens everyday.

While we may not know what happens to us in the near (or far) future, it’s good to get your ducks in a row just in case.

Just like signing a will, life insurance ensures that our families is taken care of should we meet an early death.

AIA offers such a benefit with their life insurance package A-Life Idaman.A-Life Idaman

Even with our children financially protected, we may have other family members who depend on us. Our spouse, our parents, and even our siblings. A-Life Idaman makes this wish possible by offering insurance for your entire family.

Protect your family with a financial safety net in the unfortunate event of your passing or total and permanent disability with this family takaful plan.

Here are the benefits of this package:- Your family will receive a lump sum payment in the event of your demise

- Get 200% of the sum covered for your death due to an accident

- Your family will receive RM5000 to arrange for Badal Hajj on your behalf should you pass away

- Your coverage will automatically extend to 100 years when your reach 70 or 80

*Terms and conditions applyMuslim Mums Approve

Planning for Uncertainties

It's important to lay the groundwork for your family’s financial wellbeing decades into the future even in your absence.

With A-Life Joy Xtra you can protect your child’s future. With A-Life Idaman, you can ensure that the loved ones you leave behind are taken care off should you no longer be around to look after them.

Sign up for A-Life Joy Xtra and A-Life Idaman today. Plan for you and your loved ones’ future now.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as medical advice from Motherhood. For any health-related concerns, it is advisable to consult with a qualified healthcare professional or medical practitioner.

For more insightful stories and fun recipes, stay tuned to Motherhood Story!

Navigation

Our menu boxes are very flexible and easy to use